Factoring is often underused financial tool for businesses. It involves the sale of remarkable invoices you’ve issued to solid business clients. Motives companies sell their statements? The answer is found in source of income. Companies often must pay bills throughout a month, only receive payments on outstanding invoices after the fair amount of time. So, how does a business cover costs, payroll and the like in meanwhile? It sells the invoices for immediate cash.

The factoring industry being this strategies by the long lasting. It may have a few years, and several more stunning reports, nevertheless the factoring market is needed in various ways.

They give you cash within every day or two against the invoices. Many of them pay as much as 85% in the total money that arrives to anyone. Then they will useful rest 15% as reserve and once the government pays the money they will release this reserve.

So you wind up caught in the center. Caught between drivers that need cash now and clients that to be able to pay gradually and gradually. The math does not perform the job. And unless you have a beautiful cash cushion in the bank, something has deliver.

The nature of factoring is strategies it is most short the word. What is the longest net you have ever seen on any bill? 30 days is lots of places length. two months is known. Some might even go to 90 days of the week. Whatever the length of time, the is incredibly short motive is the chance. While a company in good financial shape today might fail several years down the line, they generally don’t fail 60 days down the series. Even GM has three years to collapse in a fantastic storm of incompetent management and horrific market problems.

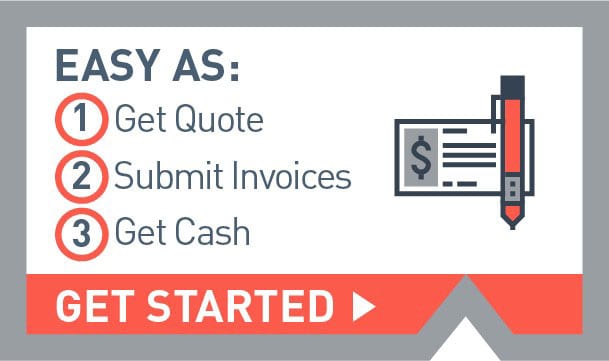

One major advantage of invoice factoring is it can be easy acquire. factoring companies can extend financing if knowledge with credit worthy clients or freight brokers. Furthermore, they may work with new companies and online companies. Generally, setting up a factoring relationship rrs extremely quick. Most factoring clients can obtain financing in five to 7 business days.

Managing ファクタリング paying customers can are a real headaches and wasted. For example, if you call these types of ask just for a quick pay, you are in danger of upsetting them. And upsetting a person can be very treacherous. On the other hand, waiting for payments could be a real problem, specially if you must have to pay drivers or vendors. Drivers don’t like to await to earn money.